Nexo Reviews

The ecosystem of DeFi and cryptocurrencies in general is a very dynamic environment, characterized by the constant innovation of the actors who operate there. This condition is mainly the cause of the birth of such excellent tools as Nexus intended for crypto-investors. It is a platform with very laudable ambitions and has already attracted more than 5 million users globally. Knowing the main functionalities of Nexo, its advantages, as well as its mode of operation is therefore essential for any crypto-investor who would like to seize the opportunities that this exchange offers. If you are looking for valuable information about Nexo, you have definitely come to the right place. Discover in this comprehensive review everything you need to know about the use, features and benefits of this investment platform.

Overview of Nexo

Nexus is an exchange present in more than 200 countries and created in 2018 by Credissimo, a company specializing in Fintech, which manages several million customers in Europe. The concept of this platform initially launched for the exchange of cryptocurrencies is very interesting and is clearly reflected in the project's slogan: "Banking on crypto ". Nexo's objective is then to offer banking services in the specific universe of cryptocurrencies. These are precisely possibilities such as: savings, loan of cryptocurrency, the borrowing of fiduciary money… Nexo is therefore today one of the players who are truly advancing decentralized finance (DeFi).

Knowing that Nexo is above all an exchange, it is possible to exchange more than 500 pairs of assets among the most recognized tokens. Of course, the cryptos such as Bitcoin, Ethereum, Tether, Binance Coin, Ripple, Litecoin, EOS, Tron, ADA Cardano and Polkado, to name a few, are present on the site. All token trading on Nexo is done absolutely at zero fees, which is a very competitive advantage for this exchange. The conversion is done in one click and intuitively, after having selected the assets to be exchanged and then the quantity of the starting token to be converted.

One of Nexo's services that could also be of great interest to crypto-investors is trading cryptocurrencies. It will be done through a very complete trading platform where it will be possible to do spot or future trading, with leverage effects of up to x20. Traders of cryptocurrencies will thus have at their disposal a powerful tool to invest their assets and generate considerable gains.

What are the benefits of using Nexo?

Nexo is an exchange with remarkable strengths that are driving the massive adoption of its services.

Instant cash borrowing

The first advantage of Nexo, and without context its most striking advantage is that you can access a bank loan immediately. This is done without any prior credit checks, giving everyone access to credit when they need it most. You will thus be able to access a bank loan with a minimum value of $10 and a maximum of $2, depending on your assets in crypto. However, it will be necessary to put assets crypto pledged beforehand to obtain a fiat loan in return.

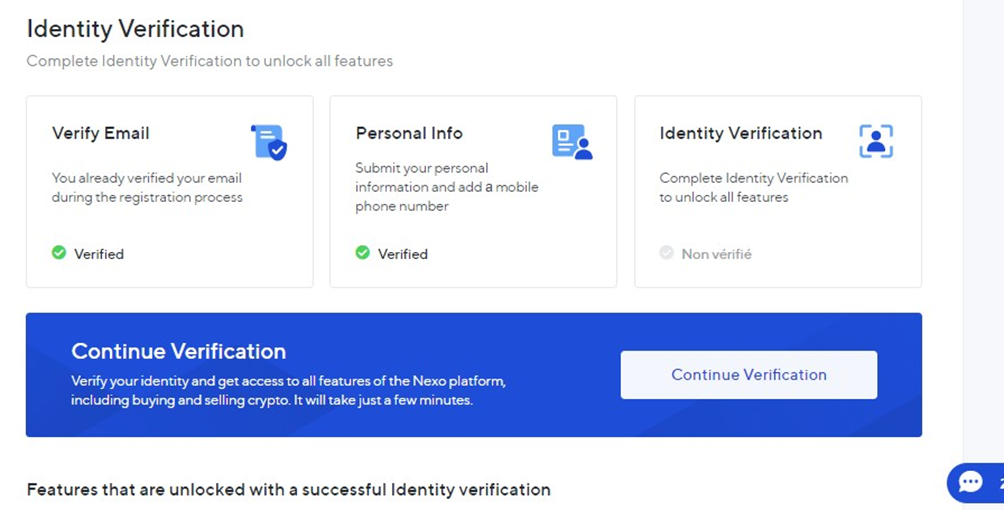

Borrowing can also be done in stablecoins and repayment is on your terms. There is no minimum amount to pay to pay off your debt. This gives you more freedom when it comes to repaying the loan. The sine qua non condition is that it is mandatory to do your account verification through the KYC (Know Your Customer) process, before you can access this service. The same is true for other Nexo features. Since it involves borrowing money, it is understandable that the company wants to have information about its customers.

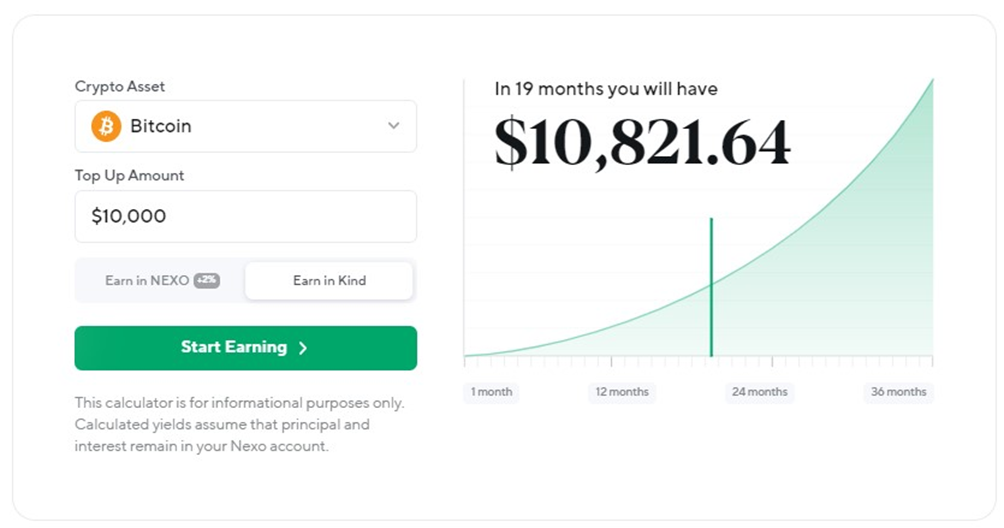

The collection of annual interest of up to 17% of your savings

With Nexo, you also have the option of staking your assets to generate gains, whether fiat currency or cryptocurrencies. It is also the flagship service of the platform. Staking on Nexo is done automatically, as soon as assets are deposited there. Your assets will then grow on a daily basis, thanks to the compound interest system paid to you each day. The most interesting thing is that the APY (annual interest rate) offered by Nexus can go up to 17% per year. This is by far one of the best rates offered for savings. Moreover, you can withdraw your assets whenever you want since the conditions are flexible.

Nexo: secure system and multi-support platform

The huge mass of assets present on Nexo certainly attracts the attention of hackers and other malicious individuals who would like to steal the assets available there. Recognizing this, Nexo has made securing its platform a priority. The leaders have therefore put in place reliable protection against hacking attempts. Indeed, Nexo has partnered with cybersecurity and compliance experts such as: Bakkt, BitGo, Ledger, Jumio, SOC 2, CLOUDFLARE or SSL SECURED.

The guarantees of reliability and security offered by Nexo are very solid and include among others:

- cold wallets insured in the event of theft up to $375 million;

- highly secure infrastructures to guarantee the optimal functioning of Nexo;

- encryption of platform data;

- security, reliability and compliance audits.

Added to this is the double authentication which is essential for making withdrawals on Nexo. With this set of features, you can rest assured that your assets are well protected and in safe hands.

Another advantage of using Nexo is that it is a multi-support exchange. It is indeed available on PC and has a dedicated application to bring its excellent services to mobile. You can download the app on all devices running Android and iOS. From the palm of your hand, you can then request a loan, view the interest generated by your account or exchange cryptos from anywhere in the world. All you will need is a smartphone or tablet with internet access.

Effective protection against market volatility cryptocurrencies

To simplify crypto-investor attracted by the loan possibilities offered by Nexo, the question of the volatility of cryptocurrencies is cause for concern. It can indeed lead to a sharp drop in cryptos against the fiat currency received, which represents a potential risk of loss. To overcome this problem, Nexo has opted for a monitoring system of the LTV (loan to value ratio) of your credit in real time. This value is set according to the cryptocollateral currency.

Its value is 50% for BTC, which means that someone who pledges the equivalent of $1500 in bitcoin will be able to borrow $725. If the price of the pledged asset falls and the LTV remains below 70%, no action will be taken by Nexo. When this threshold is crossed, however, the exchange will send you alerts about this by SMS or email. These messages will include recommendations for lowering the LTV, by making refunds or increasing the amount of the crypto pledge.

In extreme cases where the LTV exceeds 80%, Nexus will automatically pledge the other assets available on your wallet. The assets pledged at the time of the loan could be resold by Nexo, to reduce the LTV below 70%. It is a very clever and fair system that allows the exchange to cryptocurrencies to minimize the risks and to continue to provide its services so appreciated by the crypto-investors.

How to register on Nexo?

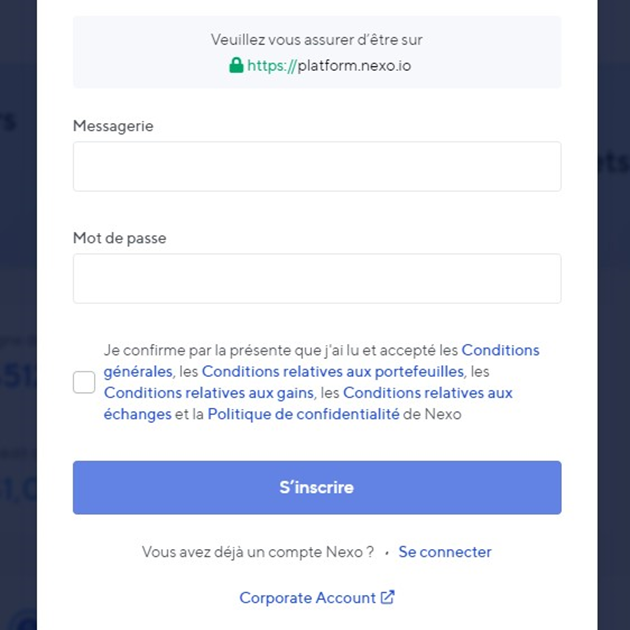

The registration process on Nexo is quite simple. Just go to the official website of Nexus, then fill in your e-mail address as well as a secret password and click on “register”. You will then receive a link in your email inbox which you will need to click on to confirm your account and access the trading platform. cryptocurrencies. After this quick registration, however, we recommend that, even if the risk of hacking is very low, you do not delay in securing your account to avoid disappointment due to potential security breaches.

To do this, click on the icon at the top right of the screen, then on “Security”. Then click on “2FA settings” to activate two-factor authentication. You can use Google Authenticator to do this or SMS authentication on your mobile. It will also be necessary to complete the KYC process to access Nexo features. To do this, you will need to provide information about your identity such as your first and last name, as well as your address and telephone number. It will then be necessary to submit a photo of your ID and then confirm your identity using online facial recognition software. Having a smartphone with functional front and rear cameras is essential to pass this process.

Validation of KYCs on Nexo is done in a few hours or within 24 working hours at most. It should be pointed out that creating an account on this platform entitles you to two separate wallets for the two main products offered. It is a savings portfolio and a line of credit portfolio. You will be able to deposit and withdraw fiat money or cryptocurrencies from each of these wallets, within a certain limit.

The savings wallet allows unlimited deposits of crypto-assets and has a maximum fiat deposit limit of $2 per transfer. For withdrawals, the maximum limits are $000/day and $000/day respectively for cryptocurrencies and for fiat currencies. As for the line of credit portfolio, there is also no limit for deposits in crypto. The withdrawal limit in crypto is $2/day with this credit line wallet, which is very interesting.

The steps to deposit and withdraw funds on Nexo

The deposit of funds on Nexus is very simple. Make sure you are on the “Dashboard” tab and scroll down the page to find the list of assets available on the platform. At the level of the asset of your choice, click on "Transfer", and in the small drop-down menu that will appear, press on "Reload". You can also directly click on the wallet icon right next to the "Transfer" tile.

This action will bring up a pop-up window whose second field will allow you to choose the funding alternative for your Nexo account. You can opt for a deposit from an external wallet (External Wallet) or from Nexo Pro Exchange which is quite simply an advanced trading platform that Nexo makes available to its users who may be interested in speculating on the cryptocurrencies with leverage.

If you select External Wallet in the second field of the pop-up window, a third field (Network) will appear to allow you to choose the type of blockchain for the transfer of your cryptos. The available networks and their number to choose from vary depending on the crypto. But all the most popular blockchains are indeed present: ERC20, TRC-20, BSC (BEP20), Bitcoin or Matic, to name a few.

You can also make your deposit by purchasing cryptocurrencies directly on Nexo. To do this, click on the “Add Funds” button on your dashboard. Then, select the payment method that suits you best: credit card or bank transfer. The next step is to enter the details of this payment method and select the cryptocurrency to buy and the amount to spend. Then confirm your order. Your bank account or card will be debited, and the corresponding asset will be added to your Nexo wallet.

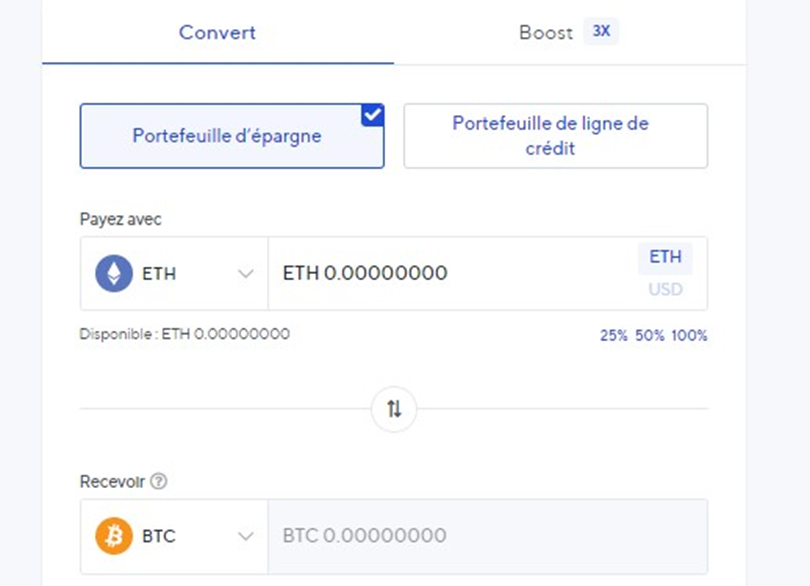

The exchange of cryptocurrencies on Nexo

To exchange cryptocurrencies on Nexo, simply hover your mouse cursor over "Convert" to bring up a drop-down menu where you will have to choose "Convert". Then select the portfolio (savings or line of credit) from which you wish to make the exchange and then the cryptocurrency to be converted and that to be received. Finally, enter the quantity of assets to be exchanged. Then click on “Trade Preview” and complete the transaction. You will not be charged any fees for this conversion, and there is also no limit to the amount of tradable assets.

Borrowing from Nexo: detailed operation

To have liquidity quickly with the borrowing service on Nexo, several steps must be followed.

Charging your wallet with cryptos on Nexo

Top up your wallet on Nexus with cryptocurrencies is the first thing to do to get a loan. Once done, the Nexo Oracle will automatically determine the maximum amount you can borrow, and you will be eligible for it without delay. The loan rate is between 0% and 14%, calculated according to your loyalty status and the LTV used for the loan. We recommend using stablecoins (USDT, USDC, etc.) to borrow money on Nexo. You can thus be protected from possible fluctuations in the assets due to volatility. Your first deposit of $100 entitles you to a bonus of $25 in BTC.

Obtaining the Nexo loan

Simply click on “Borrow” to obtain a loan or to initiate a cash withdrawal. You will see at the top of this insert, the total amount you can withdraw. Choose the payment method by which you wish to receive the loan, then enter the amount to be borrowed. Provide the necessary information and then confirm the request, and you will receive the requested money very quickly.

The repayment of the Nexo loan

Regarding the repayment of the loan, you can click on “Repay” and follow the instructions. Several methods of reimbursement are possible, namely payment by card or bank transfer. You also have the option of repaying your loan with NEXO tokens or by selling a portion of the cryptocurrencies held on your Nexo wallet. As a reminder, you will have no constraint with regard to the terms of reimbursement.

However, be careful of drastic falls in the price of collateral assets which could well cause damage. Pay close attention to the alerts sent by Nexo in this regard to intervene quickly. If you wish to withdraw your cryptocurrencies in your account Nexus, this will only be possible in the event that you have enough assets to repay the loan taken out.

Generation of interest on your cryptocoins with staking on Nexo: detailed process

The staking of cryptocurrencies on Nexo is one of the strong points of this exchange and the advantage of which all crypto- investors would like to benefit. As with the loan service, it is first necessary to make a deposit in cryptocurrencies on the Nexo platform. Once done, staking will start automatically and interest will be calculated from then on. Their payment will be made 24 hours after your deposit, and it is daily. You will be able to follow these interest payments in detail by consulting your dashboard.

As for the interest rate received, it is generally between 8% and 12%, fixed according to the assets staked. Holding savings made up of half NEXO tokens will also allow you to benefit from additional interest of 2%. Opting for payment in NEXO tokens exclusively for interest on other staked assets also allows you to obtain an additional 2% bonus on your winnings. Finally, you will also receive dividends on cryptoNexo native currencies. With this set of earnings, your holdings in crypto can grow very quickly.

Nexo user fees

Lagrasse is the perfect setting for crypto-investors, know the fees for using a trading platform cryptocurrencies is essential. In the case of Nexo, no fees are charged with respect to the exchange or withdrawal of cryptos. There are, however, brokerage fees that will be paid on the trades you make through the pro trading platform available on Nexo. For spot trading, takers will pay fees between 0,07% and 0,20%, compared to 0,04% and 0,20% for makers. As part of futures trading, the fees will be between 0,0300% and 0,0600% for takers and have not yet been announced for makers.

The NEXO token: what is it for and why own it?

The NEXO token, as you might guess, is the native token of this exchange platform. cryptocurrencies. It was distributed to the first investors and users of this exchange, during an ICO (Initial Coin Offering). The NEXO token is very important, knowing that it is the bridge that links the exchange platform of cryptoNEXO coins and the Ethereum blockchain network on which it was founded. It is indeed thanks to this asset that the exchange communicates with Ethereum and gives it the instructions necessary for its operation. The NEXO token then occupies a central place in the ecosystem of the eponymous exchange and also serves other purposes.

NEXO is 560 million tokens in circulation as of January 27, 2023, with an estimated price of $0,823 and a market capitalization of $460,42 million. Owning NEXO tokens gives you many benefits such as higher payout rates on your staking assets. You will also be entitled to lower rates for the repayment of your loans or to cashback-type offers on purchases and transactions made on the platform. These benefits mainly depend on your loyalty status, which determines the percentage of NEXO tokens in your wallet.

There are 4 loyalty statuses which are as follows:

- Base: having less than 1% of its assets in NEXO;

- Silver: having between 1% and 5% of its assets in NEXO;

- Gold: having between 5% and 10% of its assets in NEXO;

- Platinum: hold more than 10% of its assets in NEXO.

Depending on your preferences and objectives, you can then redeploy some of your other assets to hold a few NEXO tokens, in order to benefit from the advantages associated with holding this token native to the platform.

Usefulness of the Nexo card and the process of obtaining

It is a debit card that works exactly like any other bank card with the particularity of being tied to Nexo. With this virtual and international card, you can directly spend money available on your line of credit, without first accessing the Nexo platform. This can be very convenient for day-to-day or one-time expenses and there are no additional charges for using this card. It also offers you 2% cashback for your purchases and trades made on this DeFi-focused platform. So you have everything to gain by using it. To obtain it, simply order it using the Nexo Wallet application, which will also allow you to manage your transactions on the card. Then simply repay with your crypto or fiat your loan by clicking on “Repay”.

If you want to try the platform, Nexo $25 offer in BTC for a first supply of $100, to take advantage of it, it's by here.